Securities Borrowing and Lending (SBL)

SBL is a transaction where securities are transferred on a temporary basis from a lender to a borrower. The borrower is obliged to return the securities to the lender either on demand or at an agreed date. The borrower provides collateral with an agreed margin and pays a fee for the transaction, whilst lender receives a fee for the transaction.

SBL has been acknowledged by many markets as one of the important market component to improve market liquidity, price discovery, facilitating hedging and risk management activities.

SBL is conducted through negotiated transactions in the over-the-counter market.

SBL is regulated by the Securities Commission Malaysia and Bursa Malaysia.

What We Offer

With the aim of creating new value for our clients, Kenanga is offering our clients an opportunity to participate in our SBL service that help address client investment needs.

Kenanga SBL Service provides two services:

(a) Retail Securities Lending Service – A great way to earn extra income on securities you already own

(b) Retail Securities Borrowing Service – An effective tool to enhance your trading strategies

Retail Securities Lending Service

Don’t let your securities sit idle in your CDS account. Let your securities work harder for you!

- Retail Securities Lending Service offers opportunity for an investor (lender) to lend out securities to Kenanga (borrower), in a prudent way to:

- to earn extra income, without hassle and at minimum cost.

- to enhance yield on portfolio of securities.

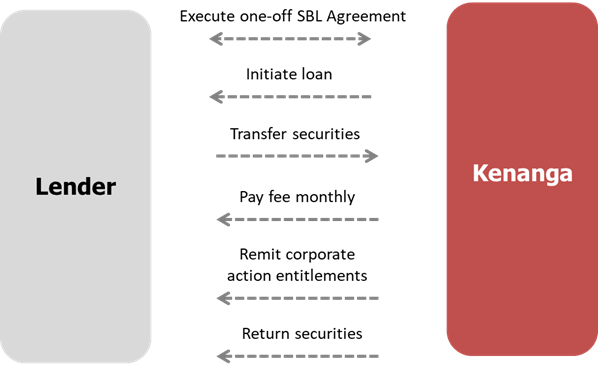

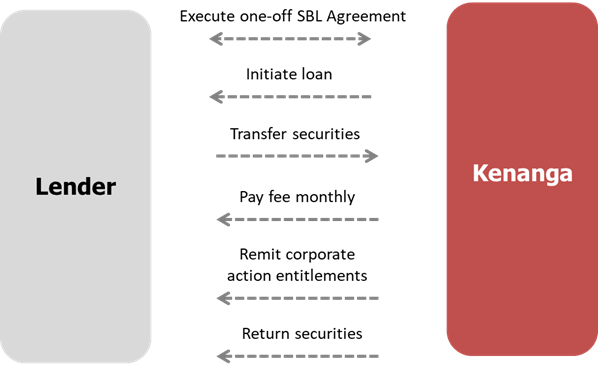

- The loan is typically arranged on an open basis. Lender can recall or Kenanga can return loaned securities at any time.

- The lender receives a fee from Kenanga for the loaned securities.

- More than 200 securities are eligible for lending.

- The terms and conditions of the securities lending transactions are governed by a SBL Agreement executed between lender and Kenanga.

Other terms & conditions shall apply

Benefits

Earn Extra Income

Fees calculated daily and paid monthly

Enhance Yield On Your Portfolio

The higher borrowing demand for your shares, the higher your potential earnings

Retain Corporate Actions Entitlements

Economic benefits are retained with you, except voting rights

Minimum Disruption To Your Trading Activities

No minimum lock-in lending period

Minimal Risks

This service is managed through a conservative risk approach & a dedicated team

Minimal Cost

Minimal transfer fee & processing fee waived until further notice

Hassle Free

A simple sign-up process

|

Eligibility

Who is eligible?

This service is offered to ALL investors (individual or corporate) who maintain securities in their CDS accounts whether maintained with Kenanga and/or outside of Kenanga. |

Is there a minimum quantity for Retail Securities Lending?

You are eligible to lend any securities with a minimum of RM100,000 in value that is free from liens, charges and encumbrances. However, due to the nature of certain loans, Kenanga may borrow the securities based on quantity available. |

What are the securities eligible for lending?

Bursa Malaysia prescribes a list of eligible securities (based on the criteria of minimum market capitalisation, free float and trading volume) for borrowing and lending.

This list is published at here

However, Kenanga may be selective or impose additional conditions. Please contact your Dealer’s Representative, our branch or SBL Desk for the latest list of eligible securities. |

How to Participate

How can I participate in Retail Securities Lending?

You must open a SBL account with Kenanga.

Follow a simple 2-step procedures to sign up SBL account:

Step 1: Complete and sign Account Application Forms and a one-off SBL Agreement

Step 2: Submit to your Dealer’s Representative or our branch to open SBL account

Please contact your Dealer’s Representative or our branch for a set of account opening pack. |

How Securities Lending works

How is the Retail Securities Lending process flow like?

|

Will I be entitled to corporate actions such as dividends, bonus securities, rights issue etc of securities that I lent out?

Although securities lending involves a transfer of securities title out from lender’s CDS account into borrower’s CDS account, economic benefits remain with you, as a lender. This means that Kenanga will be required to remit the entitlements arising from corporate action in respect of the loaned securities during the loan period to you in accordance with the SBL Agreement.

However, you will not be entitled to any voting right when the securities are lent out. If a lender wishes to exercise voting right, the lender should recall the loaned securities within the stipulated timeline. |

How long must I lend out the securities?

The loan is usually arranged on an open basis.

This means that, Kenanga, as the borrower can return the loaned securities at any time or you, as the lender can recall the loaned securities at any time in accordance with the SBL Agreement.

The loan term vary from trade to trade. Some may lend out for many months, while others may be for very short term. Typically, as long as there is a demand for the security, the security will remain on loan. |

How do I find out my securities is in demand?

Demand of each security varies from time to time. To find out:

a) You may contact your Dealer’s Representative, our branch or SBL Desk; or

b) Your Dealer’s Representative or Kenanga’s authorised personnel may reach out to you |

How do I transfer my securities that I agreed to lend out to Kenanga?

You are required to complete and sign CDS transfer form and submit to Kenanga or the broking company that you maintain your CDS account (if outside of Kenanga) for the securities to be transferred for lending within the settlement date stipulated in the Trade Confirmation. |

Can I recall my loaned securities?

Yes. You may recall the loaned securities in full or partial at any time in accordance with the SBL Agreement.

However, you must provide notification to Kenanga before 12noon in order to receive returned securities within Bursa Malaysia’s prescribed settlement cycle. |

Will I be penalised if I recall my loaned securities?

No, if SBL loan is entered at open basis, the lender may recall the loaned securities at any time without penalty. However, if SBL loan is entered into on fixed term basis, recall will be subject to penalty fee determined by Kenanga from time to time. |

What if I fail to deliver securities to be lent out within the agreed settlement date?

You, as the lender shall bear the buy-in cost and any other costs incurred pursuant to SBL Agreement on the loaned securities or to pay the market value of the loaned securities to Kenanga. |

Do I receive any report or document to keep track of my loaned securities and lending fee?

Kenanga will provide you with the following:

a) Trade Confirmation upon each loan being entered and when the securities are recalled by the lender and/or returned by Kenanga; and

b) Monthly Fee Statement detailing the outstanding quantity of loaned securities and fee receivable. |

Fees & Charges

What do I earn from this product?

Lender will receive lending fee when securities are lent out. |

How is the lending fee determined?

The lending fee is negotiable. It is determined on trade by trade basis subject to demand and supply of the securities. In general, the higher the demand for your securities, the higher your potential income. |

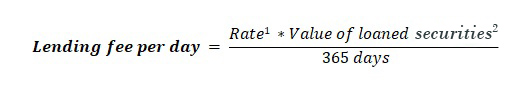

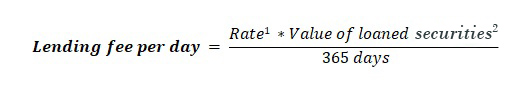

How is lending fee calculated?

Fee is calculated daily based on the closing price of the loaned securities. The fee is paid on a monthly basis.

1 rate agreed between lender and Kenanga

2 Quantity lent * the closing price of the loaned security of the preceding business day

Example:

ABC Sdn Bhd lends 1 million shares of Stock 8888 at RM2.00, at an agreed lending rate of 3%.

Lending fee per day = [3% * (1,000,000*RM2)] / 365 = RM164.38

Please note that share price of loaned securities may rise or fall depending on market conditions, which will affect potential earnings. |

Are there any other fees and charges to participate in securities lending?

You are only required to pay:

a) One-off RM10 account opening processing fee; and

b) RM10 CDS fee for transfer of each securities to be loaned out

Note: Fees and charges are subject to changes. Please refer to your Dealer’s Representative or our branch for more information and updates. |

Important Considerations

What are the other important considerations I should be aware of?

1. Counterparty risk

Counterparty risk is one of the possible risk to a lender. However, this risk is mitigated as:

a) lender’s counterparty is Kenanga, which is a strong and reputable investment bank; and

b) this service is managed through a conservative approach and a dedicated team.

2. Market risk

Lender may be exposed to the fluctuation of the price of loaned securities. |

Is SBL transaction subject to income tax?

Lending fee and manufactured payments/dividends payable may subject to different tax treatment. Please consult your qualified tax advisor, if applicable. |

Retail Securities Borrowing Service

Let’s expand your trading strategies and investment alternative!

- Retail Securities Borrowing Service allows our clients to borrow securities from Kenanga,

- to enhance trading strategies and performance.

- to facilitate hedging and other risk management.

- to cover potential failed trade to avoid expensive buy-in cost.

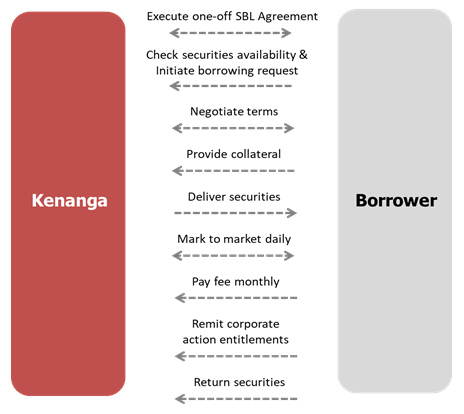

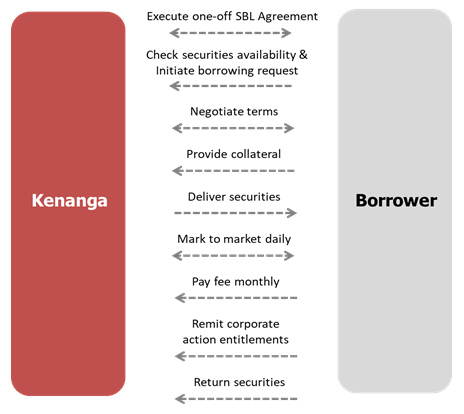

- The loan is typically arranged on an open basis. Borrower can return or Lender can recall loaned securities at any time.

- The borrower must provide collateral and pay fee to Kenanga for the loaned securities.

- Loaned securities and collateral are marked to market daily.

- The borrower is obligated to deliver all the entitlements/corporate actions arising from the loaned securities to Kenanga.

- More than 200 securities are eligible for borrowing.

- The terms and conditions of the securities borrowing transactions are governed by a SBL Agreement executed between borrower and Kenanga.

Other terms & conditions shall apply

Benefits

Allow Short Sell

For a longer period

Directional Short

With a bearish view of the market or shares

Support Hedging Activity

To hedge long position to reduce market risk

Cover Potential Fail Trade

To avoid buy-in and costly settlement fails

Support Long Short Trading Strategies

Long undervalued shares and short overvalued shares

Support Arbitrage Trading

If there is a mispricing between the Cash and Derivatives market, warrant arbitrage and so on

|

Eligibility

Who is eligible?

This service is offered to ALL investors (individual or corporate) who wish to borrow securities to facilitate their trading strategies and/or to enhance trading performance.

The borrowed securities can be delivered to your SBL/RSS account, whether maintained with Kenanga or outside of Kenanga. |

Do I need to borrow a minimum quantity for each securities?

There is a minimum borrowing value of RM100,000 for each securities. However, due to the nature of certain loans, Kenanga may lend the securities based on quantity available.

Please contact your Dealer’s Representative or our branch for details.

|

What are the securities eligible for borrowing?

Bursa Malaysia prescribes a list of eligible securities (based on the criteria of minimum market capitalisation, free float and trading volume) for borrowing and lending.

This list is published at here

However, Kenanga may be selective or impose additional conditions. Please contact your Dealer’s Representative, our branch or SBL Desk for the latest list of eligible securities and its availability. |

How to Apply

How can I participate in Retail Securities Borrowing?

You must open a SBL account with Kenanga.

Follow a simple 2-step procedures to sign up SBL account:

Step 1: Complete and sign the Account Application Forms and a one-off SBL Agreement

Step 2: Submit to your Dealer’s Representative or our branch to open SBL account

Borrowing Limit and Margin Ratio for your account will be assigned after credit assessment has been performed.

Please contact your Dealer’s Representative or our branch for a set of account opening pack.

|

How Securities Borrowing works

How is the Retail Securities Borrowing process flow like?

|

How do I find out what securities are available for borrowing?

Availability of each securities and quantity varies from time to time. Please contact your Dealer’s Representative, our branch or SBL Desk for the latest list.

|

Am I required to place collateral to borrow securities?

Yes. Securities borrowing is fully collateralised. You must place collateral with Kenanga in order to borrow securities.

|

How long can I borrow securities?

The loan is usually arranged on an open basis. This means that there is no fixed lending period.

You, as the borrower can return the borrowed securities at any time subject to prior notification to Kenanga. Similarly, Kenanga may also recall the loaned securities at any time by giving notice.

If Kenanga recalls the borrowed securities, you are required to return the borrowed securities within Bursa Malaysia’s prescribed settlement cycle. Essentially, you must buy back the securities on the same day the recall notice is issued in order to fulfil settlement obligation.

|

When will I receive the borrowed securities from Kenanga?

Kenanga will deliver the borrowed securities into your SBL/RSS account upon receipt of the required collateral.

It means that you must deliver the collateral to Kenanga by agreed timeframe before Kenanga delivers the borrowed securities into your SBL/RSS account.

|

Can I transfer my borrowed securities to my normal trading account?

No. The borrowed securities are only permitted to be transferred to your designated SBL/RSS account.

|

How do I return borrowed securities to Kenanga ?

Prior to returning the borrowed securities, you must provide a Return Notice to Kenanga. You may provide the Return Notice to your Dealer’s Representative or the SBL Desk, to perform the return.

The borrowed securities must deliver to Kenanga’s account within the settlement date stipulated in the Return Notice Confirmation.

|

What if I fail to return borrowed securities within the agreed settlement date?

You, as the borrower shall bear the buy-in cost and any other costs incurred on the buy-back or to pay the market value of the borrowed securities to Kenanga pursuant to SBL Agreement. |

What happen if there is corporate action such as dividend/income distribution, bonus/rights issue etc. for borrowed securities?

In accordance with the SBL Agreement, the borrower is required to remit the entitlements arising from corporate action if the securities are still under borrowing and have not been returned over the Record Date/Entitlement Date.

|

What happen if the borrowed securities is no longer a SBL eligible securities or suspended?

The borrower can choose to maintain the loan until the borrowed securities is returned or recalled unless otherwise prohibited by the applicable regulations.

|

Do I receive any report or document to keep track my borrowed securities and borrowing fee?

Kenanga will provide you with the following:

a) Trade Confirmation upon each loan being entered and when the securities are returned by the borrower and/or recalled by Kenanga;

b) Daily Activity Statement detailing margin position, loan position, cash and securities movement activities; and

c) Monthly Fee Statement detailing the outstanding quantity of borrowed securities and fee payable.

|

Collateral & Margin Requirements

When am I required to place collateral to borrow securities?

The Borrower must deliver the required collateral to Kenanga within the settlement date stipulated in the Trade Confirmation before Kenanga can deliver the borrowed securities into your account.

|

Does Kenanga accept any type of collaterals?

Kenanga accepts collateral in the form of cash. For non-cash collateral, please contact your Dealer’s Representative or our branch to confirm acceptability.

|

How does the Margin Ratio work?

Margin Ratio = Collateral Value 1/ Borrowed Securities Value 2

1 Collateral Value is marked to market on daily basis

2 Borrowed Securities Value (Quantity borrowed * the closing price of the borrowed securities of the preceding business day)

Kenanga may impose haircut on market value of collateral and borrowed securities from time to time.

|

When will margin call be initiated?

Margin call will be initiated against the Borrower when the Margin Ratio falls below the threshold level as agreed between the Borrower and Kenanga.

Please contact your Dealer’s Representative, our branch or SBL Desk for more details.

|

How do I rectify/satisfy margin call?

a) Top up cash;

b) Deposit acceptable non cash collateral; or

c) Return borrowed securities

|

What if I fail to remedy the shortfall within stipulated timeframe?

Kenanga has the right including to buy the borrowed securities from open market by utilizing your collateral posted with Kenanga without further notice to you and you will be liable for any outstanding loss/deficit in your account.

|

Can I withdraw the collateral?

You may withdraw collateral only if the collateral value is sufficient to satisfy the margin requirement.

To perform withdrawal, your must inform your Dealer’s Representative to call or submit Withdrawal Request to SBL Desk.

|

Do I earn any interest on cash collateral deposited with Kenanga?

Interest may only be paid for cash collateral and such interest payments will be determined by Kenanga from time to time.

Please contact your Dealer’s Representative, our branch or SBL Desk for more information.

|

Trading of Borrowed Securities

How do I perform selling of borrowed securities?

1. The Borrower must open a designated SBL/RSS account to perform the selling of borrowed securities, i.e. via Regulated Short-Selling “RSS”.

2. Prior to entering RSS order, the Borrower must obtain borrowing confirmation or has borrowed securities from Kenanga. Kenanga will deliver the borrowed securities into your SBL/RSS account on the agreed settlement date.

3. The Borrower must observe the At-Tick Rules prescribed by Bursa Malaysia. It means the Borrower can only key in RSS order at prevailing best ask/selling price or higher.

Please contact your Dealer’s Representative or our branch for more information.

|

Can I sell the securities I borrowed from Kenanga at other broking company?

Yes. You may open the designated SBL/RSS account and sell the borrowed securities at any other broking company.

You are required to provide Kenanga your designated SBL/RSS account maintained at other broking company to facilitate our transfer of the borrowed securities.

|

Am I required to sell borrowed securities immediately after borrowing the securities?

Not necessary. You may sell any time.

|

Do I need to return the borrowed securities immediately after I have bought back the securities?

Not necessary. You may keep the securities you have bought back. If you wish to return the securities, you must inform your Dealer’s Representative to call or email SBL Desk to perform the return.

|

Fees & Charges

How is the borrowing fee determined?

The borrowing fee is negotiable. It is determined on trade by trade basis subject to demand and supply of the securities.

In general, the borrowing fee will be higher if stock availability is lower. |

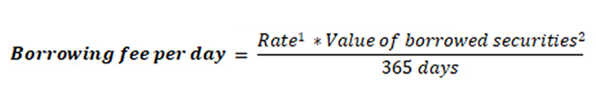

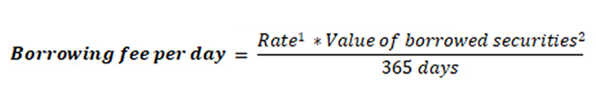

How is borrowing fee calculated?

The fee is calculated daily, commencing on the settlement date as stipulated in Trade Confirmation until such time when the securities are returned and credited into Kenanga account.

The fee is paid on a monthly basis.

1 rate agreed between borrower and Kenanga

2 Quantity borrowed * the closing price of the borrowed securities of the preceding business day

Example:

ABC Sdn Bhd borrows 1 million shares of Stock 8888 at RM2.00, at an agreed borrowing rate of 3%.

Borrowing fee per day = [3% * (1,000,000*RM2)] / 365 = RM164.38

Please note that share price of borrowed securities may rise or fall depending on market conditions, which will affect your cost of borrowing. |

What if I fail to remit borrowing fee on agreed due date?

Late payment charges will be imposed on the overdue payment balance based on the rate determined by Kenanga from time to time.

|

Are there any other fees and charges apart from borrowing fee?

a) One-off RM10 account opening processing fee;

b) RM10 CDS fee for transfer of each borrowed securities into/from your SBL/RSS account; and

c) Any other fee(s) imposed by the Exchange

Note: Fees and charges are subject to change. Please refer to your Dealer’s Representative or our branch for more information and updates.

|

Important Considerations

What are the other important considerations I should be aware of?

1. Counterparty risk

Borrower may face credit risk because borrower is required to provide collateral to the lender to borrow securities. Hence, it is important to borrow securities from a strong and reputable intermediary like Kenanga.

2. Investment/Market Risk

When you sell the borrowed securities, you, as a short seller may be exposed to market risk and as such you need to be aware of the following:

a) there is no limit on how high the price of the securities can rise hence the market risk the short seller faces, is potentially unlimited;

b) do not assume you will always be able to short sell and/or buy back at a price you want;

c) there may be unexpected risk arising from corporate action during the loan period; or

d) you may be required to deliver additional collaterals on short notice to regularise margin position if loan/collateral value fluctuates.

3. Margin Risk

SBL is a fully collateralised transaction, which means the short seller may foreclose the position forcibly, if short seller cannot rectify margin calls.

4. Recall Risk

Recall risk refers to the risk of lender recalling the borrowed securities unexpectedly. When this happens, the borrower will have to buy back the securities from the market to meet the recall timeline and has limited control on the price for covering the position.

5. No guarantee of borrowing securities

Your participation does not constitute any guaranteed borrowing by Kenanga.

6. Regulatory Risk

SBL and RSS are regulated activities being governed by the Securities Commission Malaysia and Bursa Malaysia. You must read and understand the relevant regulatory requirements and its trading mechanism prior to participation.

|

Contact Us

To learn more, please contact your Dealer’s Representative, our branches or email SBL Desk at [email protected]