4.0% Effective Annual Rate (EAR)*

With KDI Save, you get a FIXED return of 4.0% Effective Annual Rate (EAR)*, No lock-in period.

*Terms and conditions apply

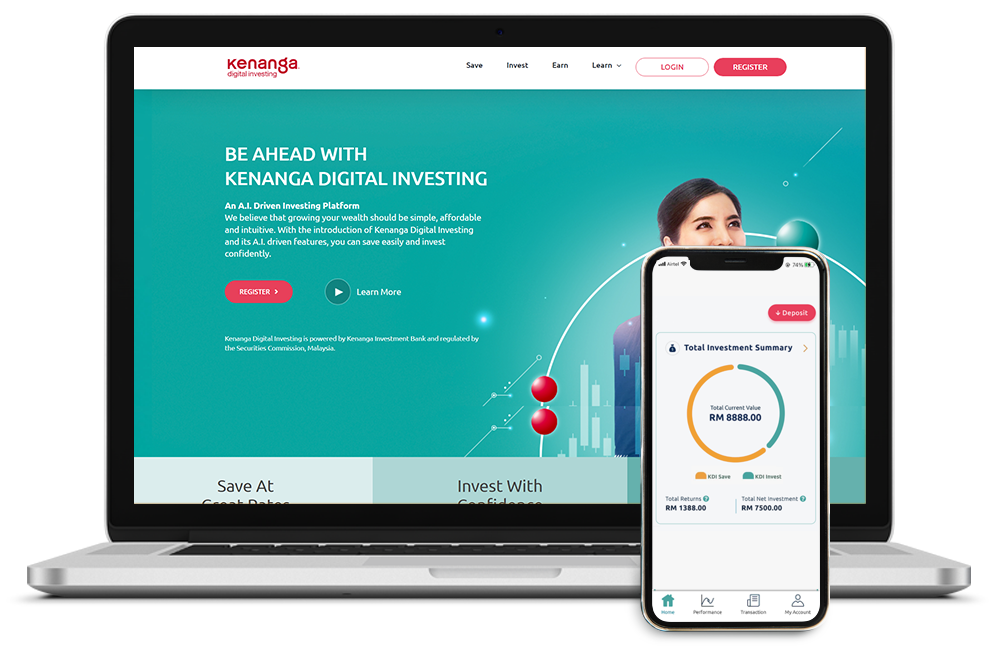

SaveInvest With Confidence

With KDI Invest, the world’s top-performing ETFs are at your fingertips.

Invest

Earn Intelligently With Technology

Our A.I. uses predictive data to manage your investments 24/7.

EarnBenefits from Kenanga Digital Investing

ZERO UPFRONT FEES

NO SWITCHING FEES

NO LOCK-IN PERIOD

FULLY A.I. DRIVEN

EFFORTLESS ONBOARDING

BACKED BY AN AWARD-WINNING FINTECH DISRUPTOR

How to

Get Started

Register an account

Submit Your Application from Web or App