Financial Services & Products

Treasury

We offer a wide range of investment and hedging solutions to our clients. We also have a dedicated team that is responsible for providing inputs on indicative pricings or levels and market updates on money, fixed income, and the foreign exchange market.

Show Me

List of Services

Short and Long Term Deposits

We support a variety of short and long term deposit options. The 3 options that we provide are Call Money Deposits, Short Term Money Deposits and Fixed Deposits.

What we offer

Call Money Deposit (CMD)

Call Money Deposit is a flexible cash management solution which has no fixed maturity date with the principal and interest payable upon notice of withdrawal. The minimum deposit required is RM500,000.

Effective Date: 5/5/2023

Rates subject to change without prior notice

| Instrument | Call Money |

|---|---|

| CALL MONEY | 2.90% |

Short Term Money Deposit (STMD)

Short Term Money Deposit is an interest-bearing deposit account for a fixed term of 1 day to 365 days at a specified interest rate with the principal and interest payable upon maturity. The minimum deposit required is RM500,000.

Effective Date: 5/5/2023

Rates subject to change without prior notice

| Instrument | Short-term Money Deposits(STMD) |

|---|---|

| 1 DAY | 2.90% |

| 1 WEEK | 3.00% |

| 2 WEEKS | 3.05% |

| 3 WEEKS | 3.10% |

| 1 MONTH | 3.15% |

| 2 MONTHS | 3.20% |

| 3 MONTHS | 3.25% |

| 4 MONTHS | 3.30% |

| 5 MONTHS | 3.30% |

| 6 MONTHS | 3.35% |

| 7 MONTHS | 3.35% |

| 8 MONTHS | 3.35% |

| 9 MONTHS | 3.40% |

| 10 MONTHS | 3.40% |

| 11 MONTHS | 3.40% |

| 12 MONTHS | 3.45% |

Fixed Deposit (FD)

Fixed Deposit is an interest-bearing deposit account of a minimum tenure of 1 month up to 60 months at a specified rate with the principal and interest payable upon maturity. The minimum deposit required is RM500,000.

Effective Date: 5/5/2023

Rates subject to change without prior notice

| Instrument | Fixed Deposits (FD) (With FD Certificate) |

|---|---|

| 1 MONTH | 3.15% |

| 2 MONTHS | 3.20% |

| 3 MONTHS | 3.25% |

| 4 MONTHS | 3.30% |

| 5 MONTHS | 3.30% |

| 6 MONTHS | 3.35% |

| 7 MONTHS | 3.35% |

| 8 MONTHS | 3.35% |

| 9 MONTHS | 3.40% |

| 10 MONTHS | 3.40% |

| 11 MONTHS | 3.40% |

| 12 MONTHS | 3.45% |

Contact Details

For more information, please email us at [email protected] or call us at +603-21676886

Important Notice

Revision on Term Deposit interest/profit on premature/partial withdrawal Dear Valued Customers, Effective 1 January 2019, no interest/profit shall be paid for premature/partial withdrawal made on Term Deposit regardless the number of completed months/days. Premature/partial withdrawal made before 1 January 2019 will not be affected by this revision. Customer may call our Treasury dealers for assistance, should the customer require further information. Call 03-21676886 for more information. Thank you for your continuous support.

Issuance of Negotiable Instruments of Deposit (NID)

Negotiable Instrument of Deposit is an interest-bearing certificate with a minimum tenure of 1 month at a specified rate of returns with the principal and interest payable upon maturity. The minimum deposit is any amount above RM60,000 and the certificate can be traded in the secondary market.

What we offer

Effective Date: 5/5/2023

Rates subject to change without prior notice

| Instrument | Non-Retail Negotiable Instrument of Deposit (NID) |

|---|---|

| Issue | |

| 1 MONTH | 3.15% |

| 2 MONTHS | 3.20% |

| 3 MONTHS | 3.25% |

| 4 MONTHS | 3.30% |

| 5 MONTHS | 3.30% |

| 6 MONTHS | 3.35% |

| 7 MONTHS | 3.35% |

| 8 MONTHS | 3.35% |

| 9 MONTHS | 3.40% |

| 10 MONTHS | 3.40% |

| 11 MONTHS | 3.40% |

| 12 MONTHS | 3.45% |

Contact Us

For more information, please email us at [email protected] or call us at +603-21676886

Important Notice

Revision on Term Deposit interest/profit on premature/partial withdrawal Dear Valued Customers, Effective 1 January 2019, no interest/profit shall be paid for premature/partial withdrawal made on Term Deposit regardless the number of completed months/days. Premature/partial withdrawal made before 1 January 2019 will not be affected by this revision. Customer may call our Treasury dealers for assistance, should the customer require further information. Call 03-21676886 for more information. Thank you for your continuous support.

Issuance of Retail Negotiable Instruments of Deposit (R-NID)

Retail Negotiable Instruments of Deposit is an interest-bearing certificate with a minimum tenure of 1 month at a specified rate of returns with the principal and interest payable upon maturity. The minimum deposit is RM10,000 and the certificate can be sold back to the bank, at the buy-back rate of 30 basis points above the bank’s prevailing market rate for the remaining tenor to maturity.

What we offer

Effective Date: 5/5/2023

Rates subject to change without prior notice

| Instrument | Retail Negotiable Instrument of Deposit (R-NID) |

|---|---|

| Issue | |

| 1 MONTH | 3.15% |

| 2 MONTHS | 3.20% |

| 3 MONTHS | 3.25% |

| 4 MONTHS | 3.30% |

| 5 MONTHS | 3.30% |

| 6 MONTHS | 3.35% |

| 7 MONTHS | 3.35% |

| 8 MONTHS | 3.35% |

| 9 MONTHS | 3.40% |

| 10 MONTHS | 3.40% |

| 11 MONTHS | 3.40% |

| 12 MONTHS | 3.45% |

Please click here for RNID Calculator.

Contact Us

For more information, please email us at [email protected] or call us at +603-21676886

Fixed Income Instruments

Our Treasury division offers various Fixed Income instruments such as Bonds, Sukuk, Short or Medium Term Notes and Commercial Papers.

What we offer

They include the following:

- Malaysian Government Securities (MGS)

- Government Investment Issue (GII)

- Cagamas Bonds

- Treasury Bills (T Bills)

- Islamic Treasury Bills (I-T Bills)

- Bank Negara Monetary Notes (BNMN)

- Cagamas Notes

- Khazanah Bonds

- Commercial Papers

- Medium Terms Notes

- Private Debt Securities

- Underwriting, subscribing and market making in new issues of Conventional and Islamic Private Debt Securities

- Placement, Sale and Distribution of new issues of Conventional and Islamic Private Debt Securities

Contact Us

Foreign Exchange

We support our clients’ foreign exchange needs including hedging of foreign currency exposure be it for trade purposes or for investing in international markets.

What we offer

At Kenanga, we offer competitive prices for Foreign Exchange Spot and Forward contracts.

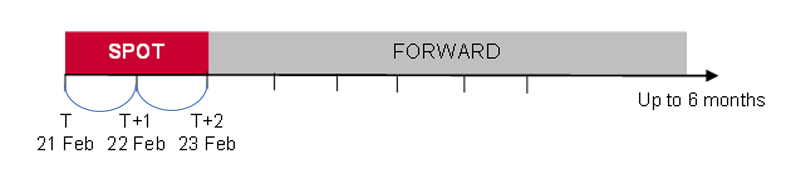

- FX Spot Contract

- An agreement to buy/sell currency at pre-agreed spot rate with delivery for value same day, value TOM (T+1) or value SPOT (T+2).

- For example:

- Trade date: 21 February 2022

- Spot Rate: JPY/MYR @ 0.036800

- Bank sells JPY10mio @ 0.036800 for value SPOT, 23 February 2022

- RM equivalent: RM 368,000.00

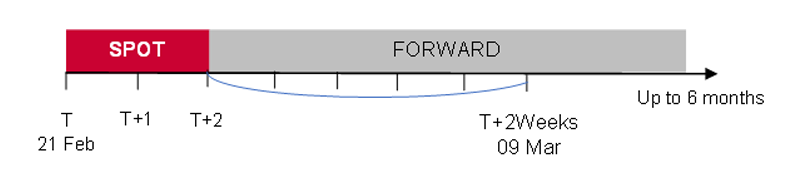

- FX Forward Contract

(only offered to corporate account and is subject to bank’s approval)- An agreement to buy/sell currency at pre-agreed exchange rate at a forward date with delivery of more than 2 business days up to 6 months

- Spot rate +/- Swap points = Forward Rate

- For example:

- Trade date: 21 February 2022

- Spot Rate: USD/MYR @ 4.2000

- Swap points: 2 weeks @ +80pips

- Bank sells USD100K @ 4.2080 for value 2 weeks FORWARD, 09 March 2022

- RM equivalent: RM 420,800.00

Foreign Exchange Policy

Bank Negara Malaysia (“BNM”) is committed in ensuring the foreign exchange policy continues to support competitiveness of the economy through facilitation of a more conducive environment for cross-border real economic activities.

You are advised to read and understand the Foreign Exchange Policies (“FEP”) and ensure all the activities performed for the accounts maintained with Kenanga Investment Bank Berhad (“KIBB”) complies with the FEP at all times.

Please note that the FEP may be revised from time to time. You are advised to get the full and latest FEP from Bank Negara Malaysia’s website.

Please refer to the following URL links to view:

Official BNM Foreign Exchange Policy Notices (1-7) (Updated 1st June 2022)

Latest updates as at 1st June 2022

https://www.bnm.gov.my/-/pd-fep-notices

Preamble & Interpretation:

https://www.bnm.gov.my/documents/20124/60360/Preamble+and+Interpretation.pdf

Notice 1 – Dealings in Currency, Gold and Other Precious Metals

https://www.bnm.gov.my/documents/20124/60360/Notice+1_Dealings+in%20Currency,+Gold+and+Other+Precious+Metals.pdf

Notice 2 – Borrowing, Lending and Guarantee https://www.bnm.gov.my/documents/20124/60360/Notice+2_Borrowing%2C+Lending+and+Guarantee.pdf

Notice 3 – Investment in Foreign Currency Asset https://www.bnm.gov.my/documents/20124/60360/Notice+3_Investment+in+Foreign+Currency+Asset.pdf

Notice 4 – Payment & Receipt

https://www.bnm.gov.my/documents/20124/60360/Notice+4_Payment+and+Receipt.pdf

Notice 5 – Securities and Financial Instruments https://www.bnm.gov.my/documents/20124/60360/Notice+5_Securities+and+Financial+Instruments.pdf

Notice 6 – Import and Export of Currency https://www.bnm.gov.my/documents/20124/60360/Notice+6_Import+and+Export+of+Currency.pdf

Notice 7 – Export of Goods

https://www.bnm.gov.my/documents/20124/60360/Notice+7_Export+of+Goods.pdf

Summary Note:

https://www.bnm.gov.my/-/liberalisation-of-foreign-exchange-policy

FAQs:

https://www.bnm.gov.my/documents/20124/2294076/2021-03-30+FAQ+on+FEP+Liberalisation.pdf

Submission of Application and Report:

https://www.bnm.gov.my/submission-of-application-and-report

FAQ’s Resident:

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Exporter.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Investing+in+Foreign+Currency+Asset.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Ringgit+and+FC+Borrowing.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Financial+Guarantee+%282%29.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Payment+in+FC.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Buying+and+Selling+of+FX.pdf

FAQ’s Non-Resident:

https://www.bnm.gov.my/documents/20124/60360/FAQs_Non-Resident+Investing+in+Malaysia.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Resident+Ringgit+and+FC+Borrowing+%281%29.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs+Notice+4+Non+Resident+Payment+in+Ringgit.pdf

https://www.bnm.gov.my/documents/20124/60360/FAQs_Non-Resident+Buying+and+Selling+of+FX.pdf

Disclaimer:

This information is for general reference only. If you require the information for any purposes, please refer to the FE Notices published at Bank Negara Malaysia’s website and obtain (as required) independent advice. Kenanga Investment Bank Berhad accept no liability for any part of this document.

Contact Us

For more information, please call us at +603-21676999

Structured Investments

We support our clients’ investment needs with an array of yield enhancement solutions which include Dual Currency Investment (DCI) and Equity Linked Investment (ELI).

What we offer

Dual Currency Investment (DCI) is a Non-Principal Protected Investment linked to a Reference Currency Pair and it is not insured by PIDM. (Perbadanan Insurans Deposit Malaysia)

DCI is a short-term currency-linked investment with potentially higher interest rate return than prevailing fixed deposit. The Investor has the flexibility of selecting their preferred Reference Currency Pair, Strike Rate and Investment Tenor.

On the Maturity Date, Investor may receive Principal Amount and Enhanced Interest Amount in either Base Currency or in Alternate Currency at the pre-agreed strike rate.

Why choose DCI?

- Higher interest rate return.

- Short term investment. (1 week up to 6 months)

- No fees and charges involved.

- Flexibility in selecting your choice of Reference Currency Pair, Strike Price and Investment Tenor.

- Suitable for Investors with investment or personal need of the alternate currency.

- Minimum Principal Amount of RM50,000 or its equivalent in foreign currency.

Who is Eligible Investor?

DCI may only be offered to Eligible Investors as defined in Part I, (1) (a) and (b), Schedule 5 of the Capital Markets and Services Act 2007 (CMSA).

For Individual:

- Total net personal assets, or total net joint assets with his or her spouse, exceed MYR3 million or its equivalent in foreign currencies, excluding the value of the individual’s primary residence,

- Has a gross annual income exceeding MYR300,000 or its equivalent in foreign currencies per annum in the preceding twelve (12) months,

- Jointly with his or her spouse, has a gross annual income exceeding MYR400,000 or its equivalent in foreign currencies per annum in the preceding twelve (12) months, OR

- Total net personal investment portfolio or total net joint investment portfolio with his or her spouse, in any capital market products exceeding MYR1 million or its equivalent in foreign currencies.

For Corporation:

- Total net assets exceeding MYR10 million or its equivalent in foreign currencies based on the last audited accounts.

For Partnership:

- Total net assets exceeding MYR10 million or its equivalent in foreign currencies.

OR

- any person who acquires the unlisted capital market product where the consideration is not less than MYR250,000 or its equivalent in foreign currencies for each transaction whether such amount is paid for in cash otherwise.

What are the key risks?

- Credit Risk/Bank Default Risk

The contract with the Investor represents a general unsecured contractual obligation which will rank equal with other existing and future general contractual obligations. If the Investor wishes to invest in this product, you should be taking note of the Bank’s credit risk and you must therefore make your own assessment of the Bank’s credit risk. The Investor is placing funds with the Bank and is therefore relying on the Bank’s ability to pay any interest and the Principal Amount at maturity. - Market Risk

The market value of this Investment is subject to many factors, including, but not limited to the foreign exchange rate, the level and shape of the relevant interest yield curve, levels of foreign exchange rate volatility and the implied future discretion and liquidity of such factors. - Foreign Exchange Risk

Foreign currency investment is subject to rate fluctuations which may provide both opportunities and risks. The Investor should note that any currency movements may potentially affect the redemption amount. Further, the Investor may experience a loss when he/she reconverts the Alternate Currency amount back to the Base Currency. The Investor should therefore determine whether any foreign currency investment is suitable for him/her in light of his/her investment objectives, his/her financial means and his/her risk profile. - Premature Withdrawal Risk

If the Investment is redeemed by the Investor prior to the Maturity Date, the Investor may LOSE PART or ALL of the Principal Amount invested. - Option Risk

This Investment is combined from many financial instruments, including options. Hence, the delivery of the Alternate Currency of the Principal Amount plus Enhanced Interest Amount is subject to the result of the options embedded in this product.

Product Highlight Sheet

Click here to view or download

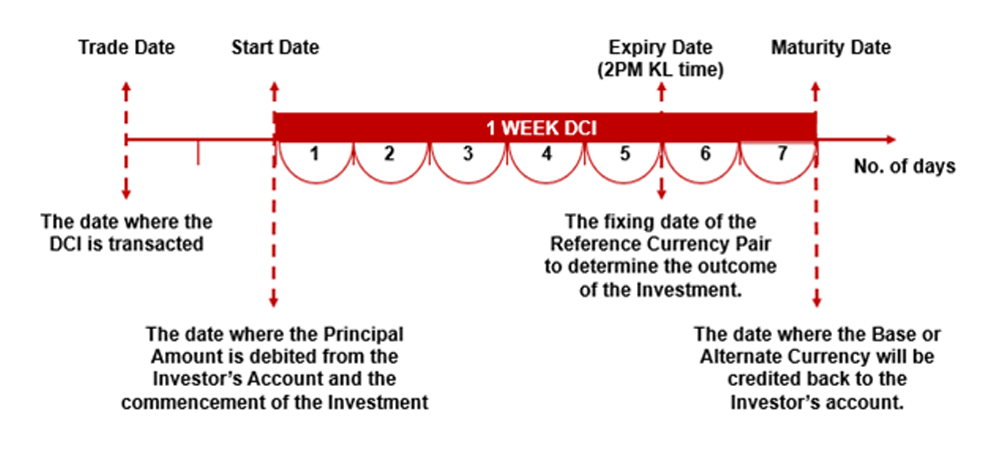

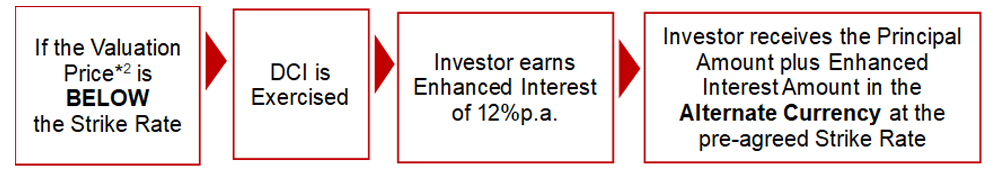

How does DCI work?*¹

| Choose your preferred Reference Currency Pair | AUD/MYR (Currency1/Currency2) |

| Decide your Principal Amount in Base Currency | MYR100,000 |

| Alternate Currency | AUD |

| (The Base Currency MYR is referred to as Currency 2 in the Reference Currency Pair) | |

| Choose your preferred Investment Tenor | 1 Week (7 days) |

| Set your preferred Strike Rate | 3.2800 -0.0050 = 3.2750 |

| Confirm the DCI Enhanced Interest (%) based on the parameters above | 12.00%p.a. |

Investment Timeline:

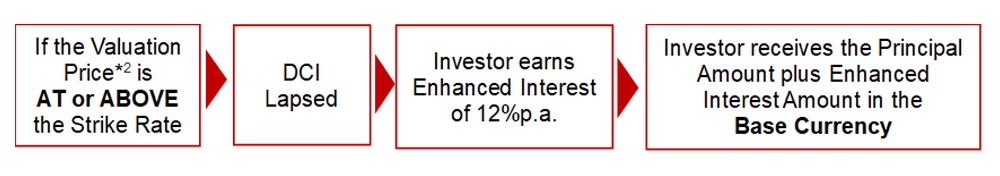

Scenario Analysis*¹:

Base Currency is Currency 2 in the Reference Currency Pair (MYR)

Principal Amount plus Enhanced Interest Amount in the Base Currency

= Principal Amount + (Principal Amount * Enhanced Interest * Investment Tenor / day-count)

= MYR100,000.00 + (MYR100,000.00 * 12.00%p.a. * 7 days / 365) = MYR100,230.14

Principal Amount plus Enhanced Interest Amount in the Alternate Currency

= [Principal Amount + (Principal Amount * Enhanced Interest * Investment Tenor / day-count] / Strike Rate

= [MYR100,000.00 + (MYR100,000.00 * 12.00%p.a. * 7 days / 365)] / 3.2750

= MYR100,230.14 / 3.2750 = AUD30,604.62

If the Reference Currency Pair Spot Rate on the Expiry Date at 2PM KL time: 3.2650 and the AUD amount is reconverted at the prevailing exchange rate, the Investor may realize a much lower return compared to 12.00% p.a. and may even realize a negative yield.

= AUD30,604.62 x 3.2650

= MYR99,924.08 (loss of MYR75.92)

*¹ The calculation is for illustration purposes and is based on the parameters above. The scenario analysis is only applicable to DCI with MYR as the base currency.

*² Valuation Price refers to the Reference Currency Pair Spot rate at Valuation Time (at 2PM Kuala Lumpur time) on Expiry Date.

Contact Us

For more information, please email us at [email protected] or call us at +603-2167 6999

Important Information

WARNING

THE RETURNS ON YOUR STRUCTURED PRODUCT INVESTMENT WILL BE AFFECTED BY THE PERFORMANCE OF THE UNDERLYING ASSET / REFERENCE, AND THE RECOVERY OF YOUR PRINCIPAL INVESTMENT MAY BE JEOPARDISED IF YOU MAKE AN EARLY REDEMPTION.

THIS INVESTMENT IS NOT INSURED BY PERBADANAN INSURANS DEPOSIT MALAYSIA.

What we offer

Equity Linked Investment (ELI) is a Non-Principal Protected Investment linked to a Reference Equity and it is not insured by PIDM. (Perbadanan Insurans Deposit Malaysia)

ELI is a short-term equity-linked investment with potentially higher interest rate return than prevailing fixed deposit. The Investor has the flexibility of selecting their preferred Reference Equity, Investment Tenor, Strike Level (%) and Strike Price.

On the Maturity Date, Investor may receive Subscription Amount and Enhanced Interest Amount in cash or receive the Reference Equity equivalent to the Subscription Amount in the form of shares. The Enhanced Interest Amount and Odd Lot(s) (if any) will be paid in cash.

Why choose ELI?

- Higher interest rate return.

- Short term investment. (2 weeks up to 6 months)

- No fees and charges involved.

- Flexibility in selecting your choice of Reference Equity listed on Stock Exchange, Strike Price and Investment Tenor.

- Suitable for Investors who are receptive towards receiving in cash or the Reference Equity.

- Minimum Subscription Amount of RM150,000 for shares listed on Bursa Malaysia, or ranges from MYR 100,000 – MYR 420,000 equivalent for shares listed on the Foreign Stock Exchange (ASX, NASDAQ, NYSE, HKEX, SGX, and JPX)

Who is Eligible Investor?

ELI may only be offered to Eligible Investors as defined in Part I, (1) (a) and (b), Schedule 5 of the Capital Markets and Services Act 2007 (CMSA).

For Individual:

- Total net personal assets, or total net joint assets with his or her spouse, exceed MYR3 million or its equivalent in foreign currencies, excluding the value of the individual’s primary residence,

- Has a gross annual income exceeding MYR300,000 or its equivalent in foreign currencies per annum in the preceding twelve (12) months,

- Jointly with his or her spouse, has a gross annual income exceeding MYR400,000 or its equivalent in foreign currencies per annum in the preceding twelve (12) months, OR

- Total net personal investment portfolio or total net joint investment portfolio with his or her spouse, in any capital market products exceeding MYR1 million or its equivalent in foreign currencies.

For Corporation:

- Total net assets exceeding MYR10 million or its equivalent in foreign currencies based on the last audited accounts.

For Partnership:

- Total net assets exceeding MYR10 million or its equivalent in foreign currencies.

OR

- any person who acquires the unlisted capital market product where the consideration is not less than MYR250,000 or its equivalent in foreign currencies for each transaction whether such amount is paid for in cash otherwise.

What are the key risks?

- Credit Risk/Bank Default Risk

The contract with the Investor represents a general unsecured contractual obligation which will rank equal with other existing and future general contractual obligations. If the Investor wishes to invest in this product, you should be taking note of the Bank’s credit risk and you must therefore make your own assessment of the Bank’s credit risk. Investor is placing funds with the Bank and is therefore relying on the Bank’s ability to pay any interest and the Subscription Amount at maturity. - Market Risk & Liquidity Risk

The market value of this Investment is subject to many factors, including, but not limited to the equity price, levels of equity volatility and the implied future direction and liquidity of such factors. - Premature Withdrawal Risk

If an Investor seeks to withdraw or early redeem the Investment prior to the Maturity Date, the Investor may LOSE PART or ALL of the Subscription Amount invested. The unwinding cost for premature withdrawal is subject to the prevailing market condition. - Equity Risk

Although the shares quantity of the Reference Equity on Maturity date is predetermined at the time of establishment of the Investment, the Investor is subject to the risks of fluctuation in the Reference Equity share price. A decline in the Reference Equity share price on the valuation date relative to the strike price would result in the Bank exercising its right to pay the Investor in the form of Reference Equity shares. The result is that Investor will purchase the Reference Equity shares at a higher price relative to the market price at maturity and could substantially (depending on the decline in the Reference Equity) reduce what the Investor otherwise had at the time invested with the Bank. Any adjustment to the Valuation Price of the Reference Equity shall be rounded down/up to the nearest 1 cent (0.01) at the absolute discretion of the Bank. - Option Risk

This Investment is combined from many financial instruments, including options. Hence, the physical delivery of the Reference Equity based on the pre-agreed Strike Price or delivery by combination of cash and the Reference Equity is subject to the result of the options embedded in this product. - Foreign Exchange Risk

Foreign Currency Investment is subject to rate fluctuations which may provide both opportunities and risks. The Investor should note that any currency movements may potentially affect the redemption amount. Further, the Investor may experience a loss when he/she converts the Foreign Currency back to his/her home currency. The Investor should therefore determine whether any Foreign Currency Investment is suitable for him/her in light of his/her investment objectives, his/her financial means and his/her risk profile.

Product Highlight Sheet

Click here to view or download

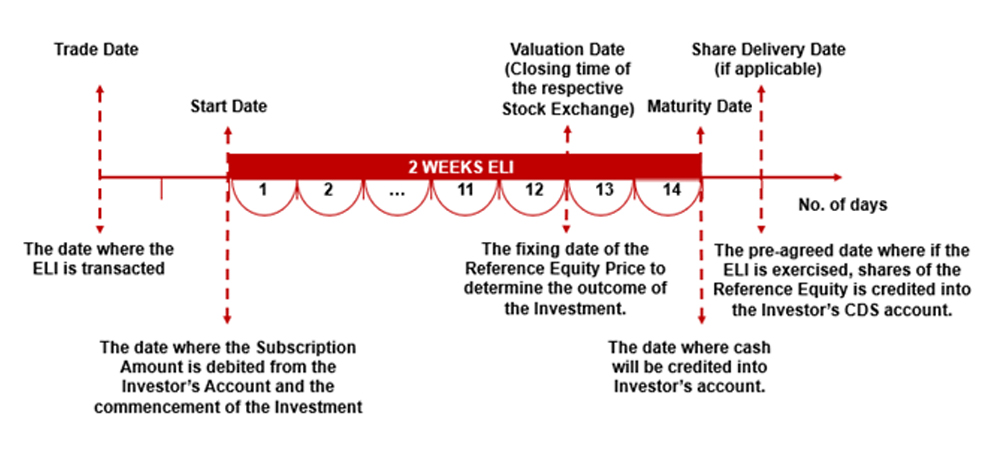

How does ELI work?*¹

| Choose your preferred Reference Equity | MYEG MK (listed on Bursa Malaysia) |

| Decide the Share Quantity (units) | 354,500 |

| Choose an Investment Tenor | 2 Weeks (14 days) |

| Set the Initial Reference Equity Price (IREP) | 0.735 |

| Decide the preferred Strike Level (%) | 96% of IREP |

| Calculated Strike Price | 0.735 x 96% = 0.7056 |

| Calculated Subscription Amount (Subscription Amount = Share Quantity x Strike Price) |

354,500 x 0.7056 = RM 250,135.20 |

| Confirm the ELI Enhanced Interest (%) based on the parameters above 25.80%p.a. | 25.80%p.a. |

Investment Timeline:

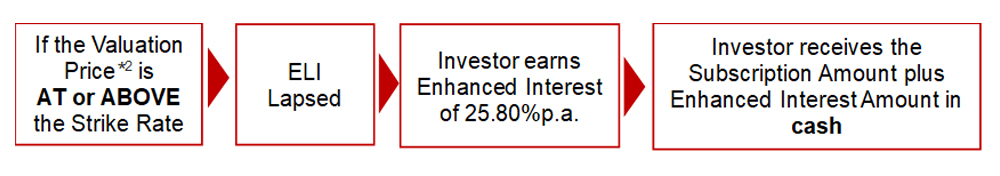

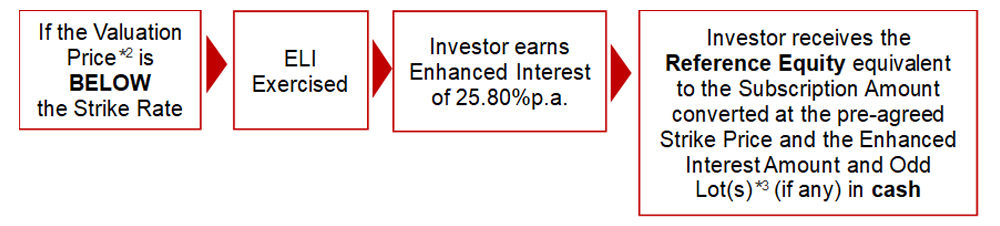

Scenario Analysis*¹:

Subscription Amount plus Enhanced Interest Amount in cash

Investment Amount = Subscription Amount + ([Subscription Amount * Enhanced Interest * Investment Tenor/ day-count])

= MYR250,135.20 + (MYR250,135.20 * 25.80%p.a. * 31 days / 365) = MYR255,616.24

Subscription Amount converted to Reference Equity at pre-agreed Strike Price plus Enhanced Interest Amount and Odd Lot(s)*³ (if any) in cash.

Reference Equity Share Quantity = Subscription Amount / Strike Price

= MYR250,135.20 / 0.7056 = 354,500 units of MYEG MK

Enhanced Interest Amount = [Subscription Amount * Enhanced Interest * Investment Tenor/ day-count]

= MYR250,135.20 * 25.80%p.a. * 31 days / 365 = MYR5,481.04

If the Reference Equity Closing Price on the Expiry Date at 5PM KL time = 0.69 and the MYEG MK shares is reconverted at the prevailing market price, the Investor may realize a much lower return compared to 25.80% p.a. and may even realize a negative yield.

Enhanced Interest Amount = [Subscription Amount * Enhanced Interest * Investment Tenor/ day-count]

= (354,500 units of MYEG MK x 0.69) + MYR5,481.04

= MYR244,605.00 + MYR5,481.04

= MYR 250,086.04 (loss of MYR5,530.20)

*¹ The calculation is for illustration purposes and is based on the parameters above. The scenario analysis is only applicable to DCI with MYR as the base currency.

*² Valuation Price refers to the Official closing price of the Reference Equity on the Stock Exchange at the Valuation Time on Valuation Date

*³ Shares listed on Bursa Malaysia are normally traded in Board Lots of 100 units. Any amount less than Board Lots are referred to as Odd Lots.

Contact Us

For more information, please email us at [email protected] or call us at +603-2167 6999

Important Information

WARNING

THE RETURNS ON YOUR STRUCTURED PRODUCT INVESTMENT WILL BE AFFECTED BY THE PERFORMANCE OF THE UNDERLYING ASSET / REFERENCE, AND THE RECOVERY OF YOUR PRINCIPAL INVESTMENT MAY BE JEOPARDISED IF YOU MAKE AN EARLY REDEMPTION.

THIS INVESTMENT IS NOT INSURED BY PERBADANAN INSURANS DEPOSIT MALAYSIA.

Kenanga FX

Transferring money overseas may sound like a headache. Not anymore. With zero transfer fee, no hidden charges and competitive rates, you can now send up to 11 different currencies abroad with ease.

What we offer

- Transfer money up to 11 different currencies

- Hassle-free with competitive rates and no hidden fees

- Secure, safe and fast payment with SWIFT system

- Easy onboarding

Contact Us

Email: [email protected]

Toll Free: 1800-88 2274

Overseas: 603-2172 2667

Visit www.kenangafx.com.my